8035858073: How to Pick Winning Stocks Every Time

The approach outlined in "8035858073: How to Pick Winning Stocks Every Time" merges technical and fundamental analysis to enhance stock selection. By scrutinizing market trends and key financial indicators, investors can identify potential opportunities. Additionally, the emphasis on diversification and strategic asset allocation suggests a methodical framework for risk management. This balanced strategy raises pertinent questions about its practical application and effectiveness in varying market conditions. What insights might emerge from further exploration?

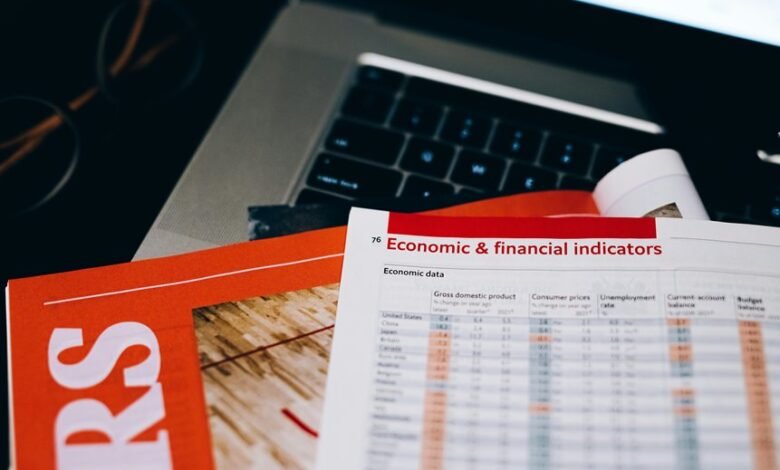

Understanding Market Trends and Indicators

Market trends and indicators serve as essential tools for investors seeking to navigate the complexities of stock selection.

Technical analysis relies on historical price movements and chart patterns, while market sentiment gauges investor psychology.

By understanding these elements, investors can make informed decisions, identifying potential opportunities and risks.

Analyzing trends and sentiment empowers investors to seize freedom in their investment strategies and optimize outcomes.

Fundamental Analysis: Key Metrics for Stock Selection

While technical analysis provides insights into price movements, fundamental analysis delves into a company's intrinsic value by evaluating key financial metrics.

Investors should focus on valuation ratios like price-to-earnings and price-to-book, which help assess relative worth.

Additionally, earnings growth indicates a company's potential for future profitability, guiding informed decisions that align with an investor's desire for financial independence and success.

The Role of Diversification in Investment Strategy

Investors who have grasped the importance of fundamental analysis must also recognize the significance of diversification in their investment strategy.

Effective asset allocation enhances diversification benefits, mitigating risk while optimizing returns. By spreading investments across various asset classes, investors can reduce the impact of market volatility, allowing for greater financial freedom and stability.

Ultimately, a well-diversified portfolio is essential for long-term success.

Conclusion

In conclusion, "8035858073: How to Pick Winning Stocks Every Time" equips investors with a robust framework for navigating the complexities of the stock market. By seamlessly integrating technical and fundamental analysis, readers uncover the serendipitous alignment of historical trends with intrinsic value assessments. This synergy not only enhances stock selection but also underscores the significance of diversification. Ultimately, the book empowers individuals to make data-driven decisions, fostering a strategic approach that coincidentally aligns with their long-term financial aspirations.